Gift Planning

Gift of Personal Residence or Farm with Retained Life Estate

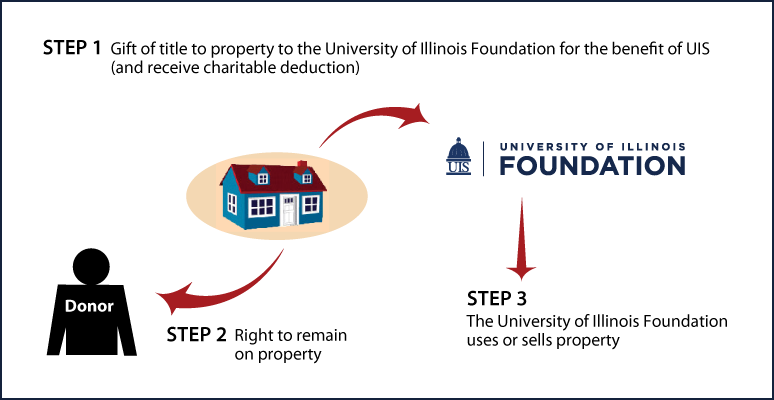

How It Works

- Transfer title to personal residence or farm to the University of Illinois Foundation to benefit UIS

- No change in your lifestyle—you (and spouse) occupy and enjoy residence or farm for life

- The University of Illinois Foundation keeps or sells property after your death(s)

Benefits

- No out-of-pocket cost for substantial gift to the University of Illinois Foundation

- Federal income-tax deduction for remainder value of your residence or farm

- You (and spouse) can occupy residence for life

More Information

Request an eBrochure

Which Gift Is Right for You?

Contact Us

|

Justin T. Seno, CFP® |

Office of Gift Planning and Trust Services |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer