Gift Planning

Life Insurance to Replace Gift—Wealth Replacement

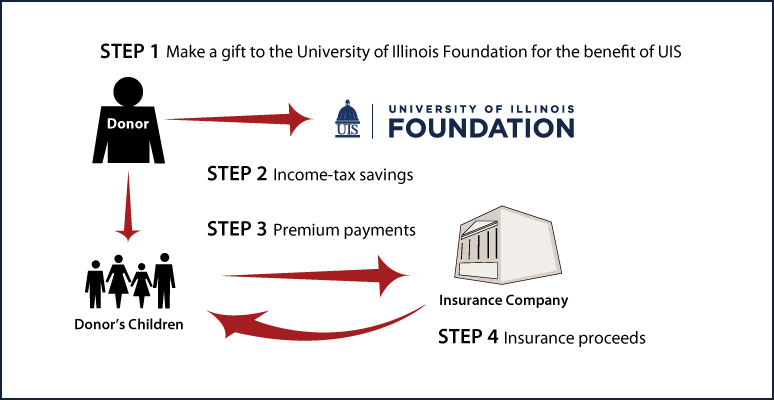

How It Works

- You make a gift to the University of Illinois Foundation for the benefit of UIS

- You give the tax savings from the charitable deduction to your children

- Your children purchase an insurance policy on your life with the tax savings

- Your children will receive the proceeds upon your death

Benefits

- You can significantly benefit UIS without diminishing the amount your family will receive

- Your tax savings finance this life insurance policy

More Information

Request an eBrochure

Which Gift Is Right for You?

Contact Us

|

Justin T. Seno, CFP® |

Office of Gift Planning and Trust Services |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer